(Note: The proposed acquisition remains subject to several conditions – including shareholder vote, Court sanction, and certain regulatory approvals. The parties hope to complete the transaction in February 2024.)

It might seem paradoxical that the venture capital industry, known for backing groundbreaking technologies and world-changing ideas, often lacks innovation within its own ranks. At Molten we have always tried to do things differently and to do them better. Which is why I’m excited to talk about today’s announcement of our proposed acquisition of Forward Partners.

The ground reality

We have known Nic Brisbourne and Forward Partners for many years. Indeed, Nic was a key figure in the Draper Esprit team, before striking out on his own to found Forward Partners, a firm we initially supported through our Fund of Funds programme. This extended to Forward Partners' public listing, where we invested in its IPO, underpinning our belief in the significance of venture capital in public markets.

The VC landscape, as we know, can be unforgiving, and despite the high quality of Forward Partners' portfolio, they, like Molten, have faced challenges in the current market conditions. We see the proposed acquisition of Forward Partners as a positive strategic move to harness Forward Partners' potential while delivering value to the shareholders of both companies. We are grateful to our shareholders for their strong support for this deal.

Innovation at Our Core

Since Simon and I founded Molten in 2006, innovation has been our lifeblood. From our early transactions to create Molten, to our diverse partnerships and market strategies, every step has been a testament to our innovative spirit in an industry traditionally resistant to change. M&A is very unusual in venture capital itself, but we have a history of doing it, including the acquisitions of the Prelude and 3i portfolios, expanding our reach and diversifying our investment capabilities.

A key alliance with Earlybird marked another significant stride, bolstering our network and investment potential across Europe. Our strong relationship with Earlybird is indicative of our dedication to collaborate with leading investors and industry pioneers, propelling our growth and reach.

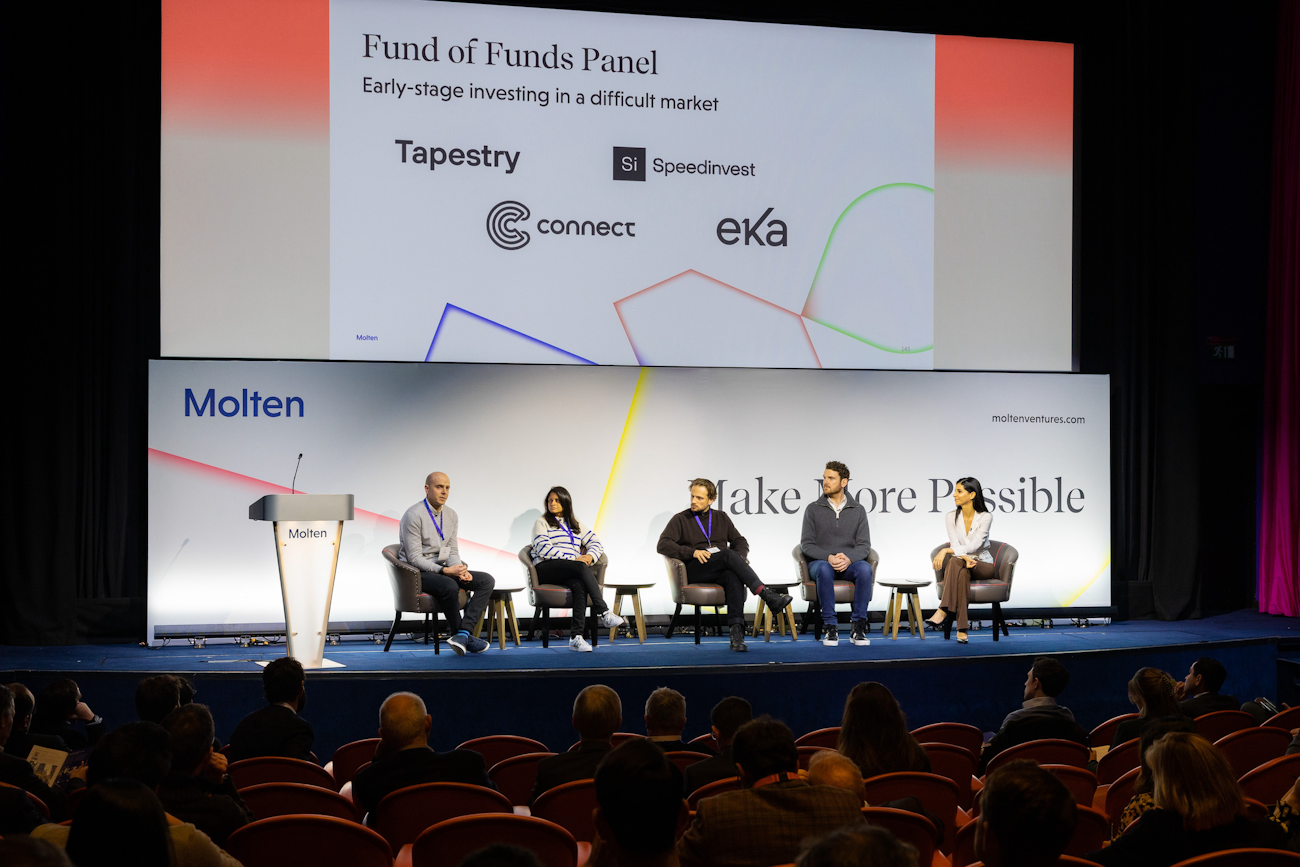

Listing on AIM in 2016 was more than a milestone — it was us stepping out of the conventional GP/LP model, a leap that allowed to break the typical constraints of VC fund cycles and the freedom to invest without some of the constraints that apply to our private VC peers. The acquisition in 2017 of Seedcamp funds I & II is an example of this, and since then our Fund of Funds portfolio has kept expanding. Today it comprises 79 seed funds across Europe and the US and stands as a robust testament to our scale and our determination to redefine the venture capital model. This isn't merely diversification; it's a conscious move to reshape the industry.

Seizing the Moment

So when posed with the current problems of the VC environment, the DNA of Molten is to go and be innovative. By merging the strengths of Molten and Forward Partners, along with the support of our respective backers, we want to redefine how VC can operate.

The proposed acquisition offers several advantages. It means we broaden our base of supportive shareholders. It will also undoubtedly strengthen our balance sheets. It will certainly enhance our talent pool.

More specifically though, it has a lot to offer when it comes to nurturing the seed-stage ecosystem, something we have made strides towards through Fund of Funds. While our FoF programme successfully bridges the gap from seed to Series A stages, there's a nuanced skill in transitioning companies from seed stage to being ready for a Series A investor like Molten. This is where Nic at Forward Partners excels. His experience and expertise, if applied not only to Molten and Forward Partners portfolios but also the 2,000 companies in the FoF portfolio, could substantially increase the returns of the entire ecosystem.

New Capital and New Opportunities

Alongside the proposed acquisition of Forward Partners, we are also today pleased to announce that Molten Ventures has successfully raised £55m in new capital—further bolstering our position.

Having been a VC since 1992, I’ve witnessed what happens during the recoveries after the cycle peaks. One truth of tech is that while investment cycles ebb and flow, entrepreneurs and the innovation never stop. Today we see an industry where valuations are normalising and we are surrounded by great companies in a range of fields — AI, Healthtech, Deeptech and Climate to name only a few. The fresh capital we’ve raised will give us the additional firepower to invest at this critical time.

Looking ahead, despite the uncertainties and liquidity constraints in the wider VC market, our portfolio remains robust, with a significant proportion of our companies demonstrating impressive growth. The hard work of their leadership and boards, supported by our investment managers, has been instrumental in reaching this stage of stability and growth. The shifting market cycle opens up new investment opportunities and a chance for us to support the broader tech ecosystem through our role as an LP in our fund of funds programme.

A Future of Innovation

Our mission to 'Make More Possible' resonates more than ever. It's not just about funding; it's about nurturing, guiding, and being part of the journey of innovation and growth. The next two years promise to be a time of strategic growth and exciting possibilities for Molten Ventures, as we continue to build on our legacy and embrace the opportunities of a changing market.

This should be seen as a signal of more innovation, a commitment to our core mission. We are dedicated to continuously pushing the boundaries of venture capital to maximise returns for our shareholders and backing the most innovative and promising entrepreneurs in every possible scenario. On this mission I absolutely don’t want to slow down.